If you are a Nigerian reading this post, you will agree with me that one big problem endemic to us, and maybe the rest of Africa is “savings”. Starting and committing to savings can be very funny as you may likely end up using the money saved in the process for some unseen expenses. Meanwhile, a 7+ year old Nigerian Fintech start-up “PiggyVest“.

Started by Somto Ifezue, Odunayo Eweniyi, and Joshua Chibueze who met first at Covenant University, Nigeria, is trying to solve this savings problem.

What Is PiggyVest? And How Can It Help You Save?

The concept is very simple; you can commit to saving as little as ₦100 a day into your online PiggyVest account, if you don’t have an account already, this link will take you to the PiggyVest website on a new tab, where you can create an account later, but make sure you get all the information I have to share with you first.

So, knowing the fact that you can save as low as ₦100 daily to you PiggyVest account, you can also decide on your own, and set an agreed withdrawal date (unless you are happy to pay a 5% early withdrawal fee), whilst all the time accruing around 6% interest per annum on automated savings.

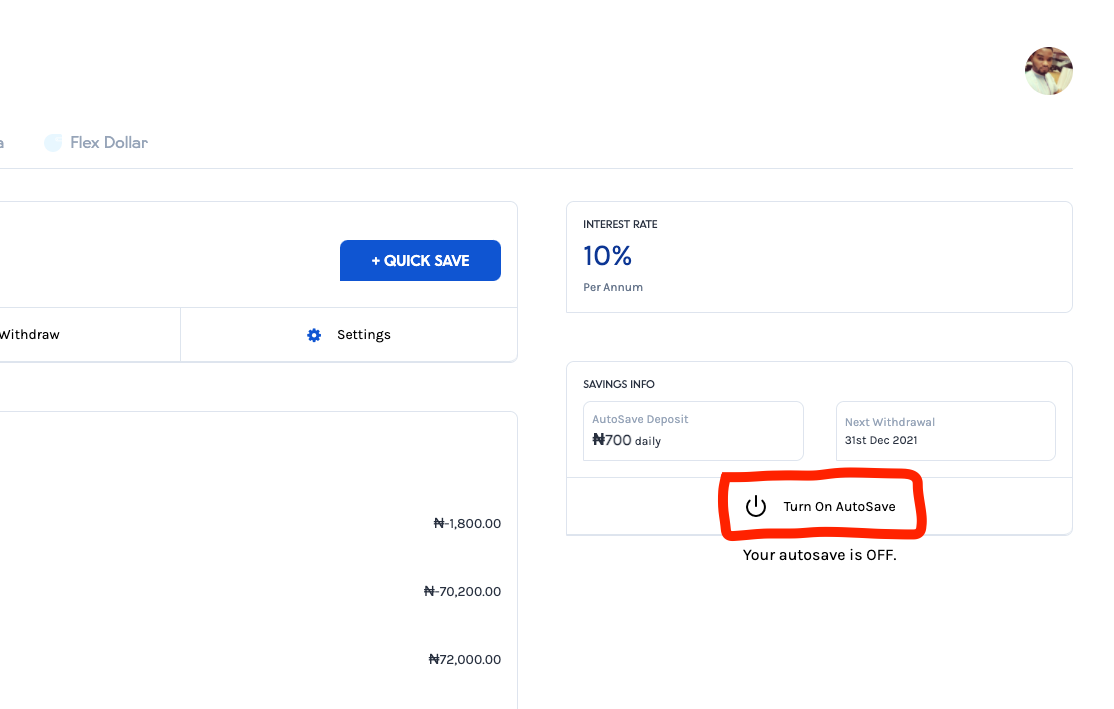

Okay, let me break that down with an example. Let’s say I decide to save ₦700 for the duration of 60days (2 months), which will amount to ₦42,000 right? Now, with the PiggyVest app, I can use the Auto Save feature which is available on the dashboard when you click on the savings tab. See the desktop screenshot below.

The app will remember my settings and debit the amount (₦700) at a particular date and time which I set daily using the AutoSave method and will continue that way until the goal is reached.

(₦700 + 60days = ₦42,000).

Note: you can increase your daily autosave amount as you please, the above figure is just an example from my own autosave.

If you ask me, this is by far the best method to make a saving plan and goal. For instance, you are saving for your next rent, to buy a phone, PC, a car, or anything you need money for later in the future but looking for a means to save very little cash that will build up over time, depending on the amount you choose to save, and the duration.

Signup with PiggyVest and get ₦1000 for free Here

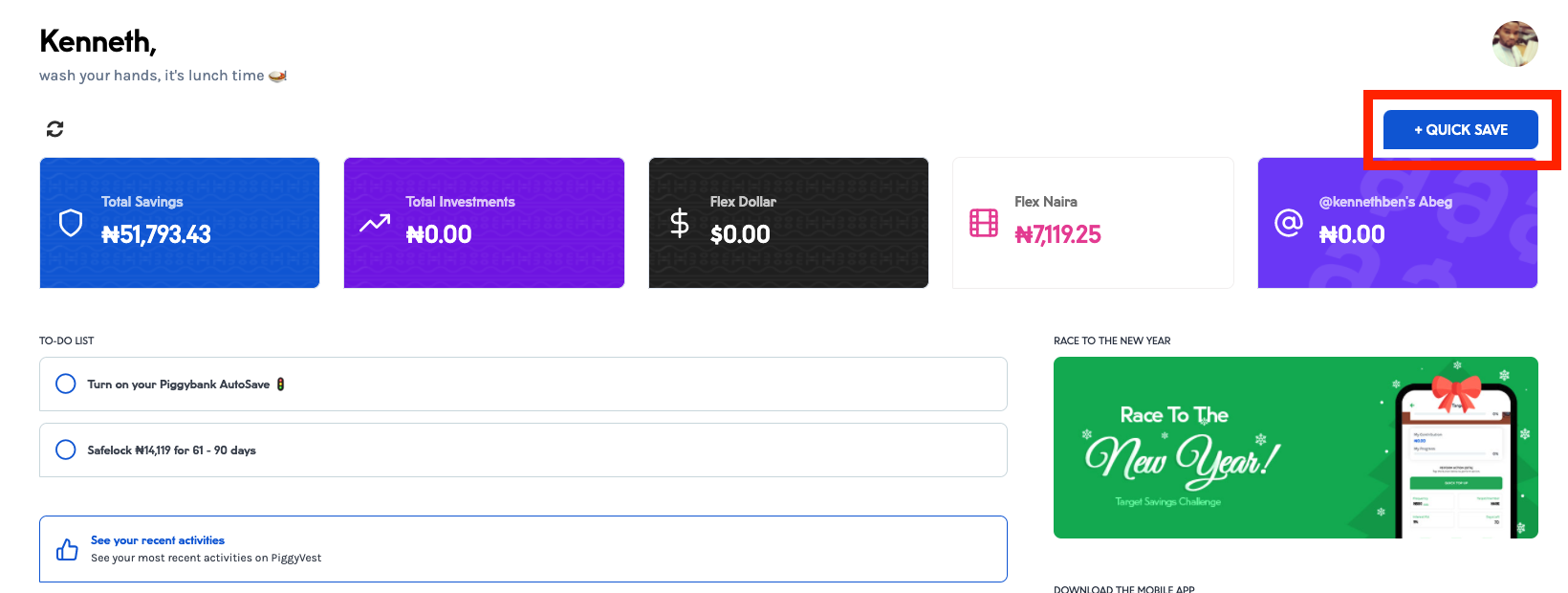

Also, there’s a Quick Save option as well. The Quick Save allows you to quickly save money you have at hand. Both options (Quick Save and Auto Save) can work at the same time.

You can have an active AutoSave running and choose to Quick Save, (as the name implies) an extra money you have at hand and don’t want to misuse, to add up to your savings cycle.

For example, I’m saving towards a ₦600,000 goal, and somehow in the middle of my savings, I get an extra cash, either from a tip or pay for an extra work. In order not to spend all that extra cash on something I don’t need at the time, I can decide to add it to my savings, by using the Quick Save method.

I can enter the amount I want to instantly add my extra funds to my PiggyVest account, choose my payment method, preferably the default card I linked to my PiggyVest account, or other means of payment that are available on the dashboard.

PiggyFlex Explained

PiggFlex Account is an account apart from your Core Savings account, where you get rewarded with points that can be converted to cash or earnings gotten from your use of the PiggyVest platform, also it’s the PiggyFlex account where your upfront interest is being paid to when you use the SafeLock feature within the PiggyVest app.

How Will I Withdraw My Savings From PiggyVest?

Things to know and consider with withdrawing your savings with PiggyVest are:

- Withdrawals are free of charge. (only on the PiggyVest free withdrawal dates, usually 3 months interval at the time of typing this)

- If you feel you need money urgently an want to break your savings goal before the set time, you will need to pay 5% of the money you are withdrawing, because PiggyVest helps its users maintain their savings discipline while building their savings culture.

- You can set your own withdrawal dates if the ones PiggyVest provided is not comfortable with you. But then, when you’ve set your own 4 withdrawals dates in a year, you can’t go back to using that of PiggyVest.

With the little tips and explanation made above you can now sign up for an account, having the basic knowledge on how to go about this great innovation, and a problem solver to savings, a problem we all face, especially the Millennials, who purchasing anything they come across online is the second nature.

Good enough, they make up 60% of the company’s registered users according to Forbes. Having recorded staggering savings growth of 3000% between 2016-17 alone.

In 2021, PiggyVest has helped over 3 million customers including myself achieve their financial goals by helping them save and invest with ease..

Signup with PiggyVest Here – and get ₦1000 getting started bonus deposited to your new account

Click Here to see a video review of PiggyVest on YouTube

Read Also: Flutterwave Store Review – How to Set Up